HİZMETLER VE ÜRÜNLER

Sizin için ne yapabiliriz?

Duyurular

Duyurularımızı takip edebilirsiniz.

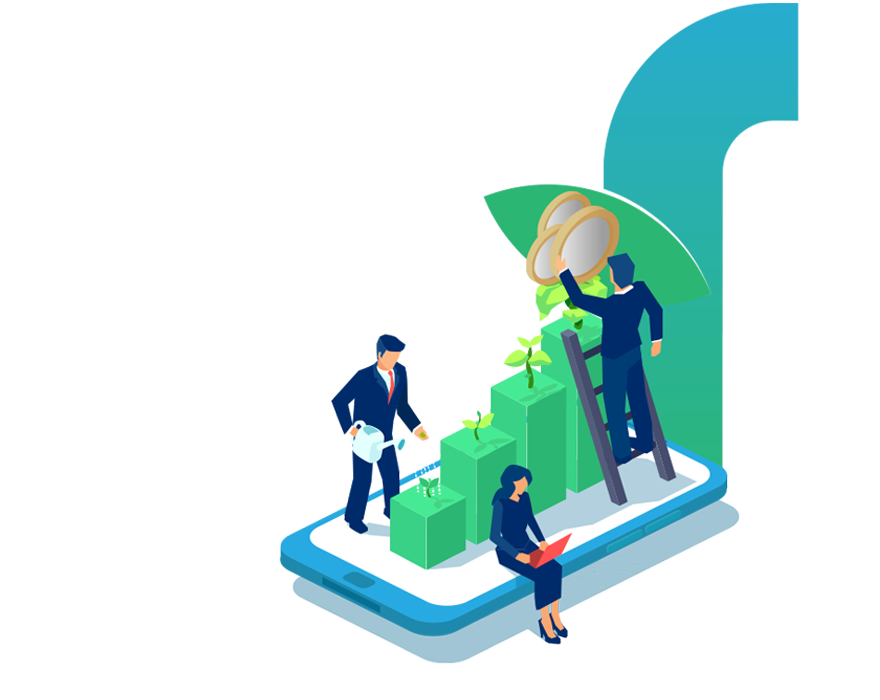

Yatırımın geleceğine

AÖS ile adım atın.

Yatırım kararlarınızı alırken ihtiyacınız olan piyasa bilgilerinin ve analizlerin tümü AÖS'te.

Makro Ekonomik Göstergeler

Güncel makroekonomik analizleri takip edin, yıllık ve son 5 yıllık büyüme analizlerini inceleyin.

Enflasyon Verileri

Devam Edin

İşsizlik Oranı

Devam Edin

Kamu Maliyesi

Devam Edin

Sanayi Üretimi

Devam Edin

Para Politikası

Devam Edin

ÖNE ÇIKANLAR

VİOP Teknik Analiz Bültenlerini Nasıl Okumak Gerekir?

Piyasalardaki birçok kurumla çalışan bir yatırımcı, yeni yıla girerken şöyle bir yorum paylaşmıştı; “Öncelikle yeni yılın sizlere sağlık, mutluluk ve daha büyük kazançlar getirmesini dilerim.